Data produced by British-American financial analysis firm Refinitv on Wednesday found China’s leading tech companies lost about $1.1 trillion in market value during the Chinese Communist Party’s two-year regulatory crackdown on the industry.

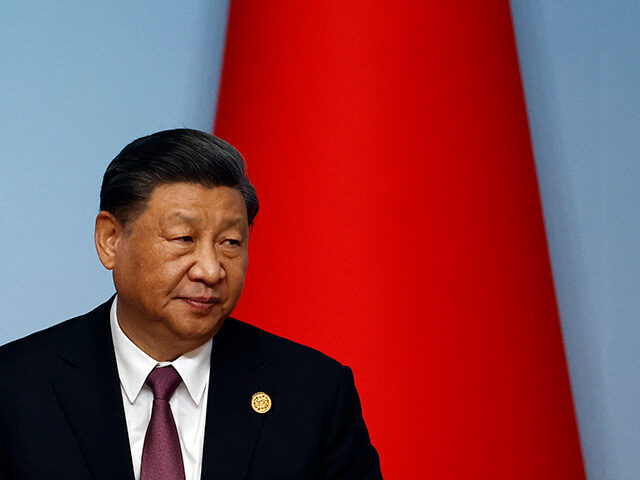

The crackdown, or “rectification” as the regime in Beijing prefers to call it, began suddenly in 2020 as a purported effort to tighten anti-monopoly regulations and improve data security. Foreign analysts suspected the real motivating factor was a desire by dictator Xi Jinping and top Communist Party leaders to bring high-flying tech executives such as Alibaba’s Jack Ma under control.

China’s tech crackdown starts to ease https://t.co/m4qr3vtZg8

— The Economist (@TheEconomist) January 23, 2023

Public criticism of foolish regulations by the flamboyant Ma at an October 2020 conference in Shanghai was the alpha event of the tech crackdown, and investors hope Ma’s return to China at the invitation of newly appointed Premier Li Qiang in March 2023 was its omega. Li was desperate to reassure foreign investors that the era of madcap coronavirus lockdowns and politically motivated regulatory crackdowns was over. Bringing Ma back from exile, and allowing him to return to Alibaba headquarters in his hometown of Hangzhou as a respected corporate elder statesman, was an effective means of sending that message.

On Friday, Ma’s financial company, the Ant Group, was hit with a $984 million fine that optimistic investors viewed as the final twist of the regime’s regulatory thumbscrews. It was one of the largest fines ever slapped on an individual company, but it still produced a great sigh of relief from investors.

Alibaba Group Chairman Jack Ma performs during the 18th anniversary of Alibaba Group at the Yellow Dragon Sports Center on September 8, 2017 in Hangzhou, Zhejiang Province of China. (Visual China Group via Getty Images)

The People’s Bank of China (PBOC) issued a statement that “most outstanding problems have been rectified.” The statement included praise for Alibaba and Tencent for helping to make China into a world-class technology power.

Flagship tech stocks Alibaba and Tencent rose sharply in Hong Kong on Monday, even though Tencent was punished with a hefty $415 million fine of its own.

“We view this announcement as a key milestone for a regular, clear and visible regulatory environment for China’s internet companies,” said a note to investors from the Huatai Securities research team.

“We believe the fines indicate that the rectification of large fintech platforms has come to an end,” concurred JPMorgan analyst Alex Yao.

The Ant Group announced a surprise stock buyback program after its $984 million fine was imposed and Alibaba may follow suit. Tencent representatives said it was not planning any comparable corporate policy changes in the wake of its fine.

The Ant Group was planning a stock IPO in 2020 but it was blocked by regulators in the early days of the crackdown. If that IPO had gone forward, the company would have been valued at roughly $315 billion. The Ant Group valuation disclosed along with its stock buyback program was only a little over $78 billion.

In addition to the Ant Group, Alibaba, and Tencent, other companies that lost major value during the crackdown included food delivery company Meituan, search provider Baidu, and e-commerce titan JD.com. The share prices of those companies fell between 40 percent and 71 percent over the past two years.

Reuters on Wednesday quoted some analysts whose optimism was tempered by concerns that Beijing cannot resist micromanaging its tech sector, especially if the next wave of high-tech products brings tech executives enough money and prestige to believe they can challenge the Chinese Communist Party’s dominance.

“Mega-cap tech companies will allocate increasingly large amounts of capital expenditure towards developing generative AI technologies and products in a hostile external environment, potentially impacting profitability,” cautioned Hong Kong-based strategist Redmond Wong.

The Economist predicted in January that the end of the “techlash” would be part of a “concerted effort to revive confidence in China’s leadership, including that of Xi Jinping” — but the Chinese tech and financial sectors might never be the same:

The new era for tech will be vastly different from the previous one, which was defined by rapid growth and unbridled expansion. Many companies have been selling businesses they bought in recent years. Entire internet-enabled industries, such as online education, have been destroyed and will not be coming back.

State control is set to increase in the coming years. Many firms have already sold small stakes to government investors. These “golden shares” often require the state to buy only 1% of a company and yet confer the right to appoint board members and veto important decisions. Shares in important subsidiaries of ByteDance, the owner of TikTok, and Weibo, a Twitter-like platform, are already held by a state investor linked to China’s cyberspace regulator. A similar arrangement has recently been made with Alibaba, an e-commerce giant, and there are rumors that the same fate might befall Tencent.

“The new normal will be a strange new place,” the Economist concluded.

COMMENTS

Please let us know if you're having issues with commenting.